Blockswap “Stakehouse” Positioned to Sweep The ETH2 Staking Market

The most innovative “one-click” ETH2 Staking Liquidity Platform to date

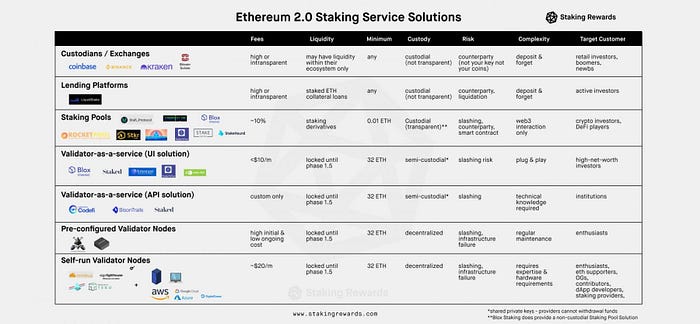

If you search “ETH2 Staking-as-a-Service Platforms” you’ll see a plethora of solutions that attempt to simplify the ETH2 staking process: Ankr, Rocket Pool, Coinbase/Binance Staking, Bison Trails, Stafi, Lido- the list goes on. Upon conducting a deep dive of all the available solutions though, one can’t help but feel underwhelmed with the options. Let’s go through the pain points one would analyze when choosing where to stake (I’ve ruled out running my own node):

Liquidity: I don’t want my ETH stuck for 2 years+

Fees: I don’t want to pay 25% on my rewards

Centralization: I don’t want to deposit with a centralized exchange…duh it’s not helpful to PoS networks either

Minimum ETH Requirement: I don’t have 32 ETH to participate with!

Community: I want to stake with my friends and community

Defi Products: I want to use my ETH in the Defi ecosystem even though its staked with ETH2!

There still isn’t a comprehensive solution that makes ETH2 staking realistic for the average Defi user. Enter Blockswap Network. This very innovative team just brought “Stakehouse” to market which is an attempt to address every concern an ETH2 staker might have when choosing a provider. Unlike any of the others mentioned above, there is no eth lockup, no fee, no centralized custody exchanges, no minimum ETH requirement, and they add a completely new way to stake with friends that doesn’t exist anywhere else in the market.

Let’s deep dive.

The most common solution for ETH2 staking will likely be with centralized exchanges, like Coinbase. These players like to take advantage of non-defi aware users or non-technical stakers who seek stable income. For them, any rate of return on their money above ETH appreciation is unheard of. These users are happily willing to pay 25% fees on their ETH staking rewards for convenience (highway robbery). Defi stakers will be hungry for that extra 25% and wont be giving it up unnecessarily. Pretty much every centralized custodial staking offer just went out the door. Coinbase, Binance, Kraken- goodbye.

The runner up solution will likely be tokenized liquidity platforms like Ankr, Stafi, and Lido that offer staked-ETH pairs available on Uniswap. Oddly these pairs are trading under peg right now. Users will also have no control of which validators are selected, there is significant risk in pooling with these service providers in case they get slashed, and let’s not forget smart contract risk from the tokenized assets.

“Slashing” is a term used to characterize the Ethereum Network’s method to penalize nodes that acted nefariously or unreliably. Stakers of these nodes will lose a portion of their funds staked.

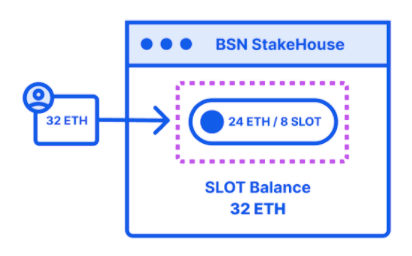

Blockswap Network’s “Stakehouse” has the full package. The architecture of providing liquidity to the staked assets is different- the best way to explain it is with a visual and a step by step process:

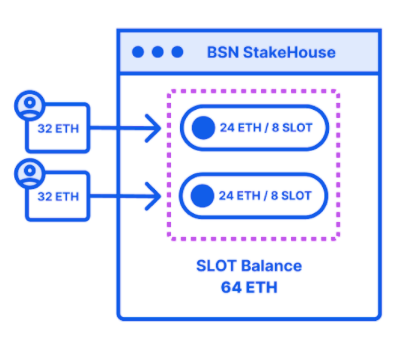

- A “Stakehouse” is like a club where people can stake their ETH together, as a community.

- When a user deposits 32 ETH to a validator “Stakehouse” they will then receive 24 dETH + 8 SLOT tokens, which are tradable at any time.

- The SLOT tokens will be representative of the 32 ETH in the Stakehouse and gain inflation yield from the ETH PoS network.

- The SLOT tokens will eventually be representative of various PoS chains, and can be combined in a “SLOT Mix” to then create a PoS index bond.

This approach is drastically different from anything else on the market and it solves all the issues addressed earlier: there are no fees for stakers, no hardware requirements, no centralized entities, and they provide an easy way to get in and out of the staked ETH.

The most unique part of Blockswap’s approach is the individual “Stakehouse” itself. Since they will be rated for performance, users will be able to choose which Stakehouse they want to stake with, in case one gets slashed too often- they can switch to another Stakehouse. In return, the Stakehouse will grow a loyal community. Blockswap will also enable the Stakehouse to have private telegrams and provide specific amenities to the stakers in their community. In the future, a Stakehouse with enough liquidity will also be able to operate more like a bank offerig different Defi services like issuing loans against their staked liquidity, and interacting with various Defi protocols that can tap into their staked assets.

This approach is entirely unique in the Defi ecoystem and is bound to gain traction among the staking community. If you’re curious to learn more, join the Telegram or Website and keep your eyes open for their incentivized CommunityNet coming to market later this month!